Drift is a perpetuals exchange on Solana that offers up to 20x leverage on perpetuals, and up to 5x leverage on spot and swap tokens. In addition to that, it offers borrow and lending and liquidity provision features for users to earn yields on their assets.

Drift Borrow / Lend

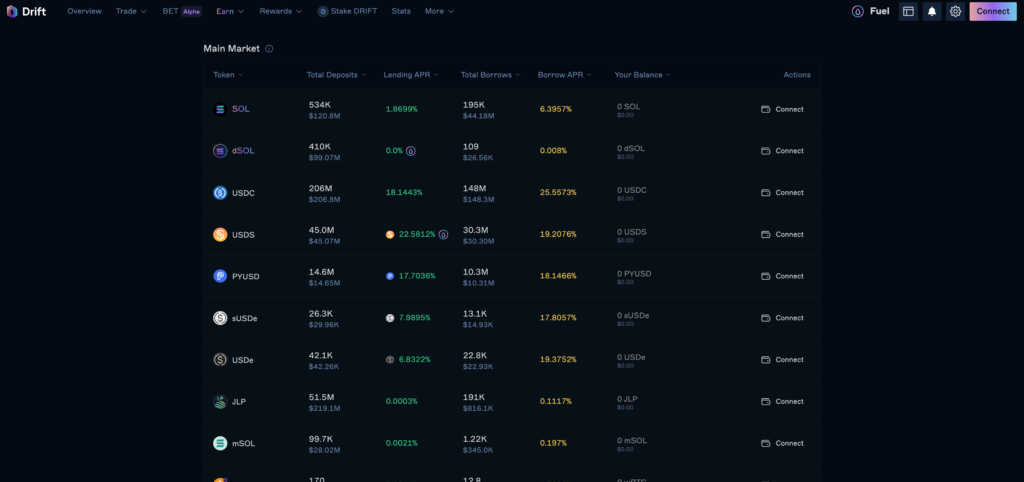

Drift Borrow / Lend is a decentralized lending market similar to Aave and Compound where you can deposit spot assets like SOL, USDC, PYUSD and earn lending yield by lending your assets to borrowers.

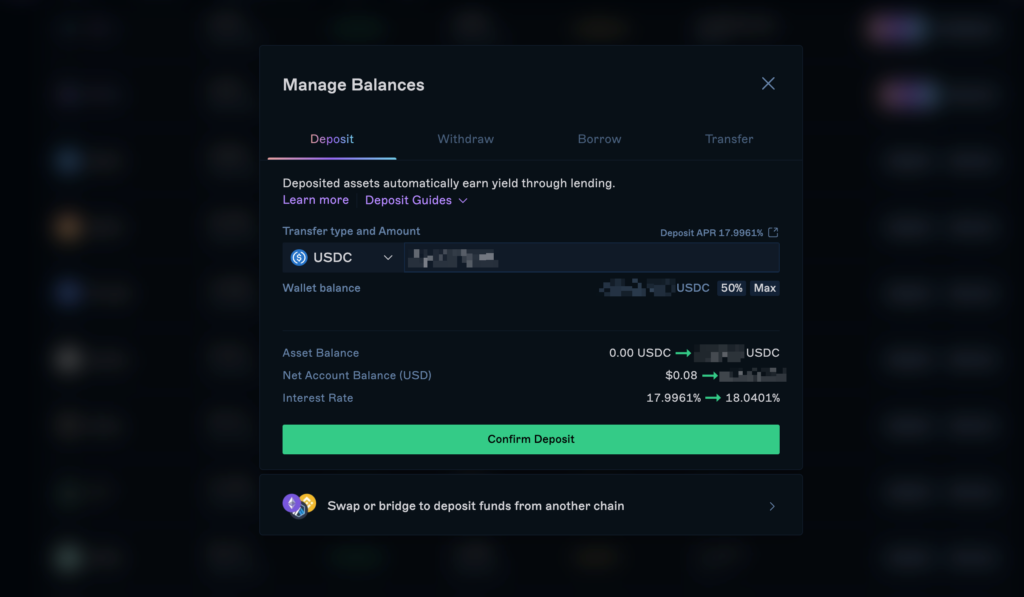

For example, choose a lending market like USDC, and earn the lending yield shown (in this case it’s 18.2% APR).

After depositing, you can also borrow other tokens from the market by paying a borrowing cost (shown as borrow APR).

Drift supports a wide variety of lending and borrowing markets from stablecoins like USDC, USDS and sUSDe to altcoins like DRIFT, W, JUP, WIF and more.

Drift Vaults

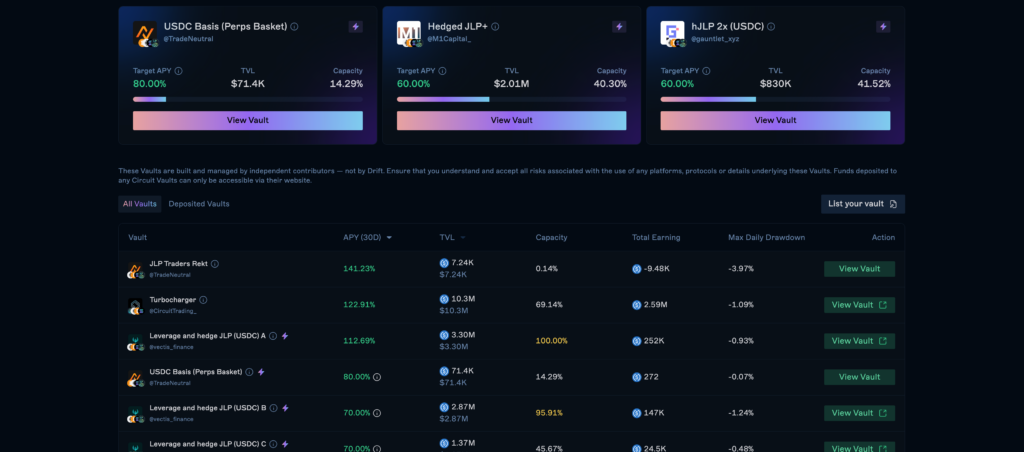

Drift Vaults are externally managed yield farming vaults where deposits are taken to earn a yield depending on the strategy used.

This is similar to a hedge fund concept, where the fund pools investors’ funds to invest in a strategy, and takes a cut of the profits.

Within Drift Vaults, you can find interesting strategies like the delta neutral JLP strategy which actively hedges and manages the JLP position to earn a close to risk-free return on USDC.

Multiple providers may offer similar strategies, so you might want to consider the nuances of each strategy provider, such as their on-chain infrastructure, fees and safety to minimize losses and spreads.

For example, Trade Neutral, Vectis Finance, Circuit and Gauntlet all offer delta neutral JLP strategies.

Insurance fund vaults

For those looking for a safer alternative to yield, Drift also offers insurance fund vaults where you can deposit USDC, SOL and DRIFT tokens to earn a portion of fees from perp trades, borrows, and liquidations.

The insurance fund is the first protocol backstop to maintaining the solvency of the exchange in the event of any bankruptcies and it is funded by premiums collected from liquidation fees, trading fees, borrowing and lending fees.

When depositing here, be aware that there is a 13-day cooldown period after an un-staking request is submitted.

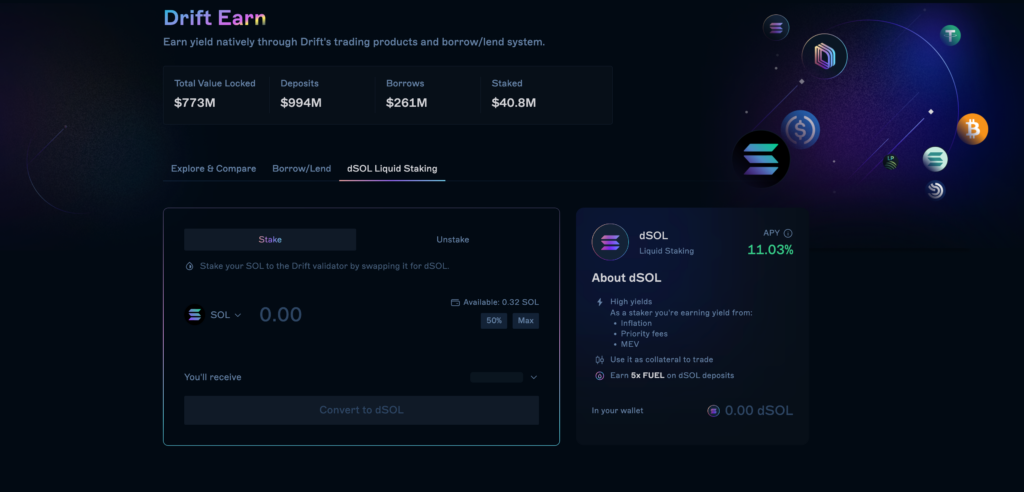

dSOL staking

Solana holders can also stake their SOL with Drift for dSOL, and earn yield from a combination of sources such as MEV, SOL inflation and priority fees. The current yield is 11%.

Conclusion

Overall, we think that Drift offers a variety of useful products where traders and investors alike can use Drift for trading and earning yield. We especially like their Drift Vaults for yield farming, and also their perps exchange for trading up to 20x leverage.