The Scaling Trilemma

For over a decade, blockchain networks have struggled with the infamous scaling trilemma – the inability to achieve decentralization, security and scalability simultaneously in a single system.

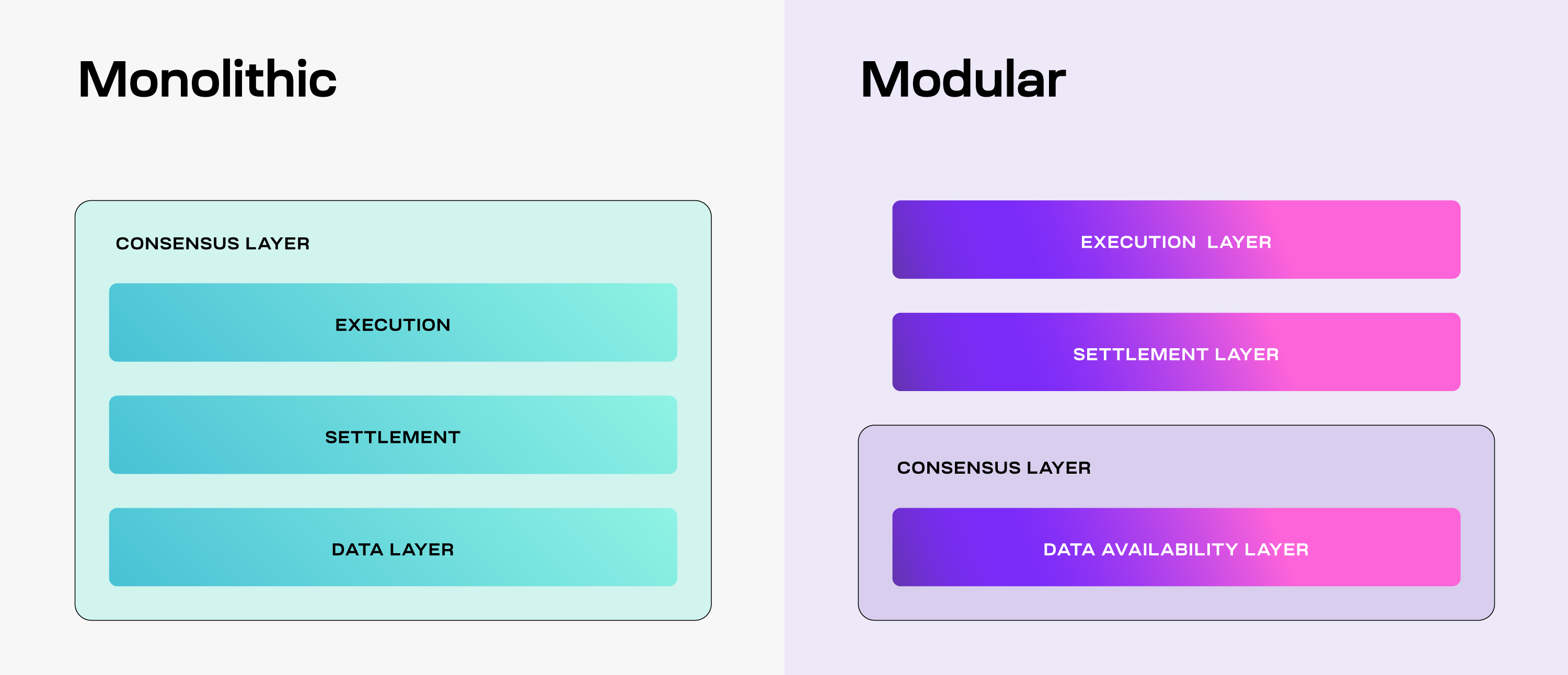

Early monolithic blockchains like Bitcoin and Ethereum bundle the core functions of execution, settlement, consensus and data availability into one cluttered chain.

While this simplistic single-chain model succeeded initially, the rapid growth of decentralized applications has exposed fatal scalability bottlenecks. As transaction volumes surge, networks grind to a halt under the weight of bloated blocks and skyrocketing gas fees.

In 2021, the average Ethereum transaction fee peaked at $70, while the network processed only 15 transactions per second. Solana raced ahead with 50,000 TPS but at the cost of frequent network outages that raise concerns over its robustness.

The crux of the problem lies in the sheer complexity of general purpose blockchains trying to handle every function. Just like a kitchen appliance cannot match the performance of specialized tools, monolithic chains cannot efficiently solve liquidity, lending and NFTs atop slow and congested base layers.

The solution requires a paradigm shift to modular blockchains with specialized layers for each function. An elegant way is to separate execution, consensus and data availability into modular components that smoothly interoperate.

While execution and consensus modularization through rollups is gaining adoption, data availability remains an Achilles heel.

Enter Celestia – the first modular blockchain network custom-built ground-up to provide abundant, secure data availability for decentralized applications.

Data Availability – the overlooked bottleneck

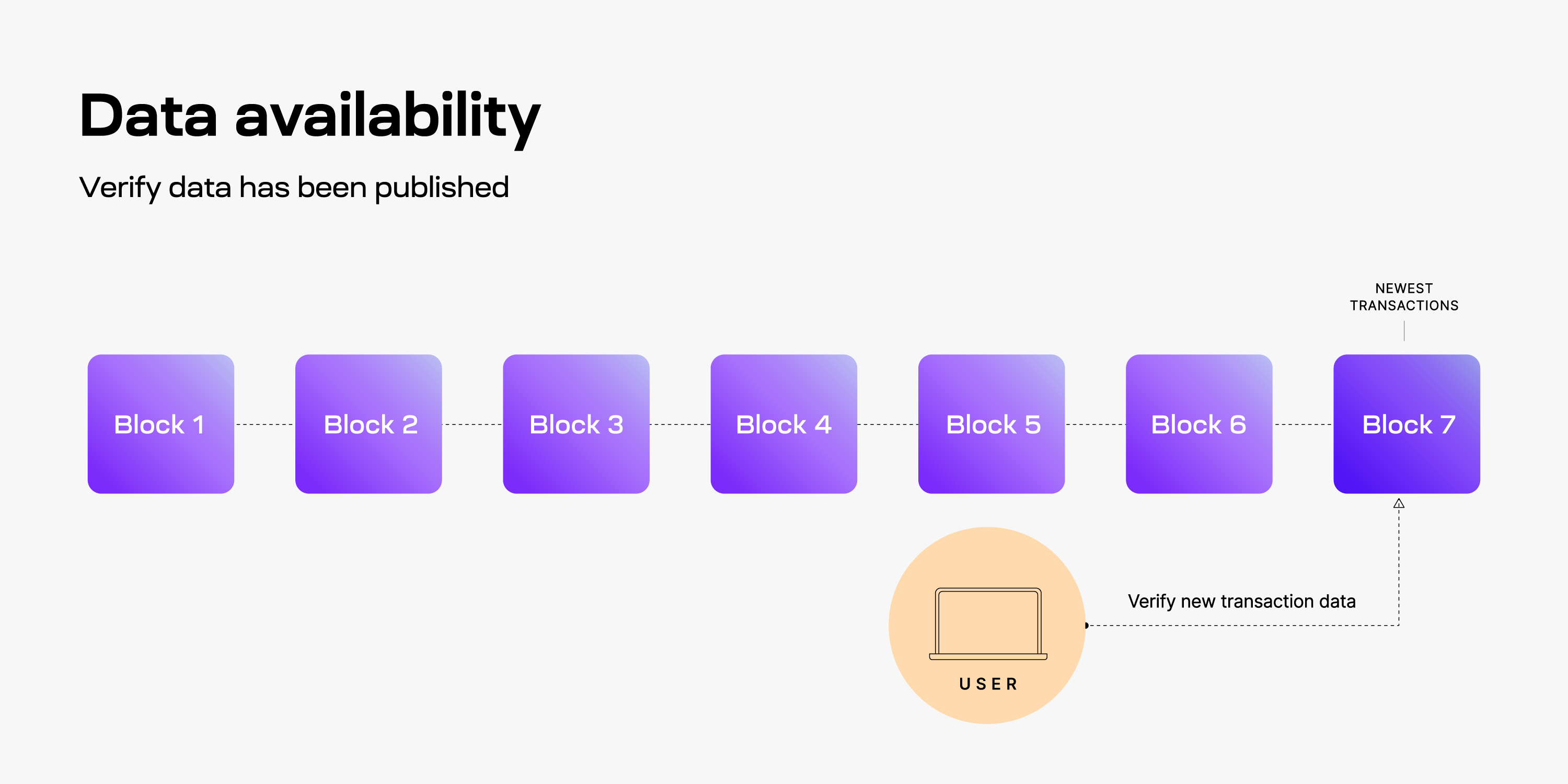

Data availability refers to ensuring all network participants can access the full set of transaction data to verify validity of blocks.

Monolithic blockchains handle this by having every node store full copies of the chain. But this rigid approach severely limits throughput and hardware requirements for nodes to keep pace with data growth.

Second layer scaling solutions like rollups must publish transaction data rather than burdening individual nodes with bulk data.

However, in the absence of robust data availability guarantees, dishonest rollup operators can easily manipulate or withhold information while issuing deceptive block headers to the main chain.

Without mechanisms to detect missing data and fraudulent data summaries, validators cannot coordinate chain sequencing properly. Moreover, light clients cannot reconstruct chain state, cascading into settlements being disputed and assets lost or stolen through falsified balance proofs.

Research by Ethereum founder Vitalik Buterin already explored efficient proofs to certify availability of off-chain data rather than having all nodes redundantly store everything on-chain.

However, these advanced cryptographic schemes need purpose-built blockchains with data availability as the primary design priority rather than an afterthought.

This sets the stage for Celestia – the first sovereign data availability network specifically optimized to facilitate modular execution environments.

By liberating data availability from monolithic chains, Celestia unblocks rollups, sidechains and sharding to explore richer on-chain activity.

Inside Celestia’s revolution in data architecture

Celestia flips existing data architectures through a refined “separation of concerns” approach.

It divides network duties between specialized blockchains instead of one chain haphazardly juggling everything.

At its core, Celestia focuses exclusively on two minimal but essential consensus functions – ordering transactions and ensuring their data availability – nothing more. The burden of transaction execution and validity is offloaded to modular “rollup” chains purpose-built for applications.

This clean delineation brings three major advantages over traditional data architectures:

- Flexibility: Developers can customize execution chains with any language, tooling or performance trade-offs needed for their apps without being limited by the consensus layer’s rigidity

- Scalability: With execution separated, the consensus layer uses advanced cryptography to verify data availability without actually processing all transactions, overcoming bottlenecks

- Interoperability: Using a common data availability backbone improves connectivity between the metaverse of execution chains for seamless cross-chain asset movement and messaging

Under the hood, Celestia enshrines availability using an elegant cryptographic scheme called data availability proofs.

They certify – to over 99% confidence – that full data behind block headers exists publicly without having to download everything, using just small random fragment samples, allowing massive scaling in how much data the blockchain can handle.

Then what stops validators submitting limited subsets of transaction data? Well, that’s where erasure coding magic comes into play. Even if parts of a data set goes missing or get strategically withheld, it remains recoverable from much smaller encoded chunks spread redundantly across blocks.

Nodes can still successfully reconstitute the full block despite missing pieces, foiling any censorship attempts. Together with fraud proofs, this mathematically guarantees both security and scalable data throughput as Celestia evolves into a decentralized data cloud for on-chain activity across platforms.

Sovereign rollups through custom blockchains

While data availability is the nucleus of Celestia’s modular architecture, it powers an entire galaxy of extended functionality through rollups.

For external execution chains, Celestia provides a robust underlying consensus mechanism to mint blocks, sequence transactions and publish data.

Rollup chains essentially outsource all heavy data availability work and get porcelain-smooth access to Celestia’s industrial-grade data infrastructure without operational headaches.

This frees them to focus exclusively on transaction execution, customization for specific apps and experimenting with bleeding-edge features.

Rollups running on Celestia benefits from dynamic scalability as more light nodes verifying data availability boost the overall network capacity. Rollups also gain stronger integrity assurances against fraudulent data thanks to Celestia’s live fraud proofs.

Unlike most rollup systems needing Celestia’s native TIA token as gas fees to post transactions, special “Sovereign Rollups” can use their own tokens to pay fees. This grants them financial autonomy reminiscent of independent sidechains.

Hence, projects get best-in-class data availability without sacrificing flexibility or customization freedom to fuel native tokenomics.

Everything from decentralized social media to AI-based execution layers can manifest easily as sovereign rollups tapping into Celestia’s infinite data cloud.

$TIA as native gas for Celestia’s data economy

The lifeblood fueling Celestia’s functionality is its ERC-20 native token TIA. With one billion total supply distributed over years, TIA facilitates key network operations:

- Data Availability Fees – Rollup operators rely on Celestia for inexpensive but robust data infrastructure. TIA provides the native gas metering this enormous storage and bandwidth on demand

- Deploying Rollups – Developers leverage TIA as collateral and gas to deploy new sovereign rollups harnessing Celestia for data needs

- Staking Rewards – TIA lets node operators and validators secure the network and earn block provisions for maintaining integrity

- Governance Rights – All protocol changes happen through TIA weighted votes, fully decentralizing Celestia’s evolution

Additionally, around 6% of TIA was strategically distributed to external communities on Cosmos, Ethereum and prominent rollup ecosystems.

Conclusion

Celestia introduces a revolutionary modular architecture for blockchains that promises to overcome endemic scalability limitations.

By finely separating the data availability layer into a standalone decentralized network powered by unique cryptographic proofs, Celestia enables rollups, sidechains and sharding schemes to realize their full transactional potential.