BasedApp is a new platform designed to empower users to spend, send, and invest in crypto on the go, powered by Web 3.0 technologies.

BasedApp crypto debit card

The BasedApp debit card is a blockchain-based debit card that offers features for crypto natives:

- Spend with stablecoins

- Low FX fees

- Earn cashback for spending with the card

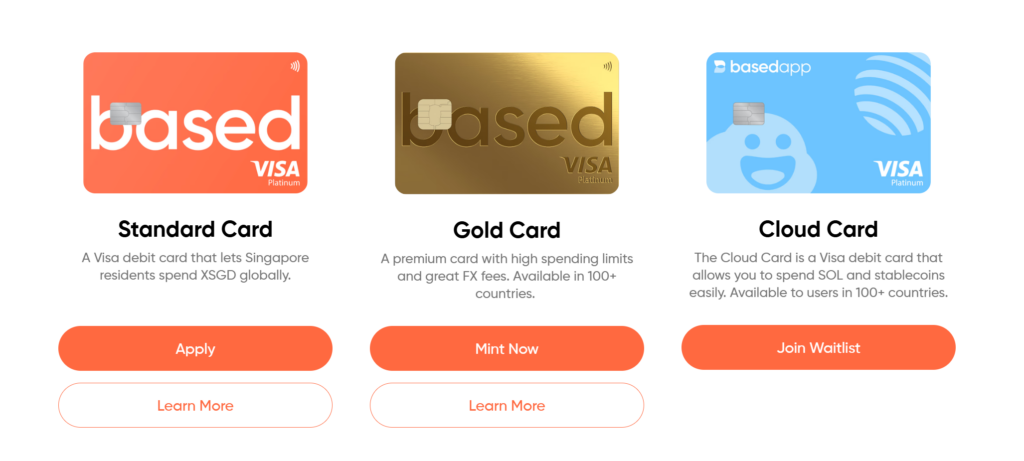

Currently offered in 3 different tiers, the Standard Card is a Visa debit card that allows Singapore-based residents to spend XSGD with any Visa based merchant.

The Gold Card is a limited-edition premium gold-plated 20g metal card that comes with even higher spending limits of up to $30,000 per day, and available in more than 100 countries beyond Singapore.

Finally, the Cloud Card is an upcoming card that allows you to spend SOL and stablecoins easily.

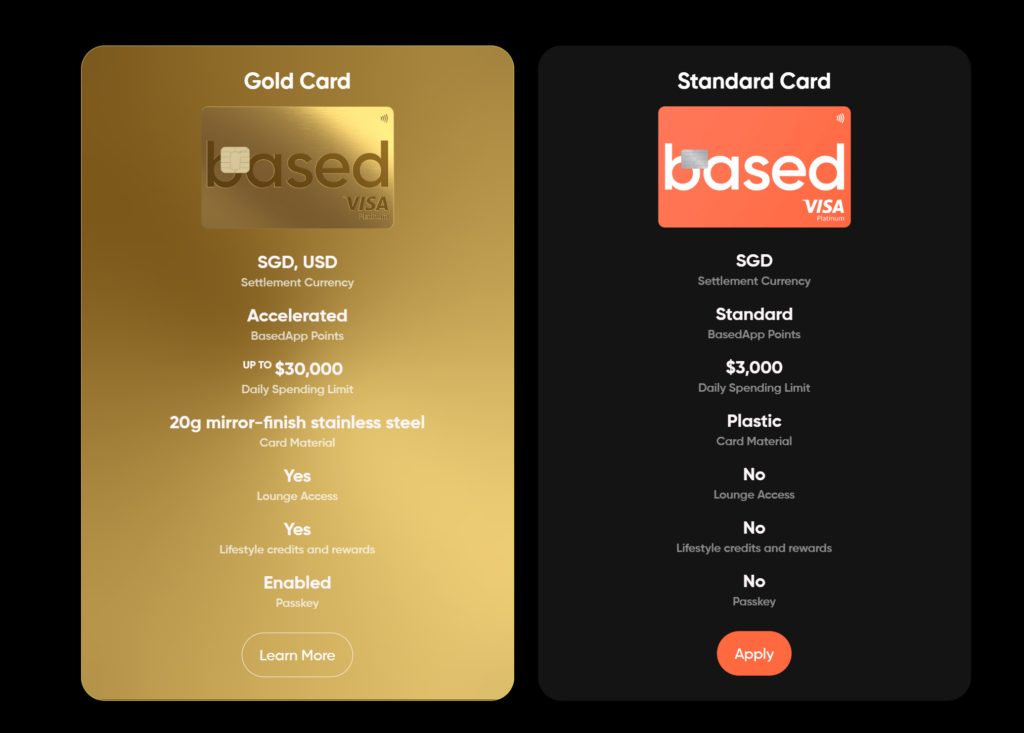

Comparing Based Standard Card vs Gold Card

From the table above, you can see that the Gold Card is similar to premium banking cards like the Citi Prestige card, where you get lifestyle perks in addition to an accelerated earn rate of BasedApp points.

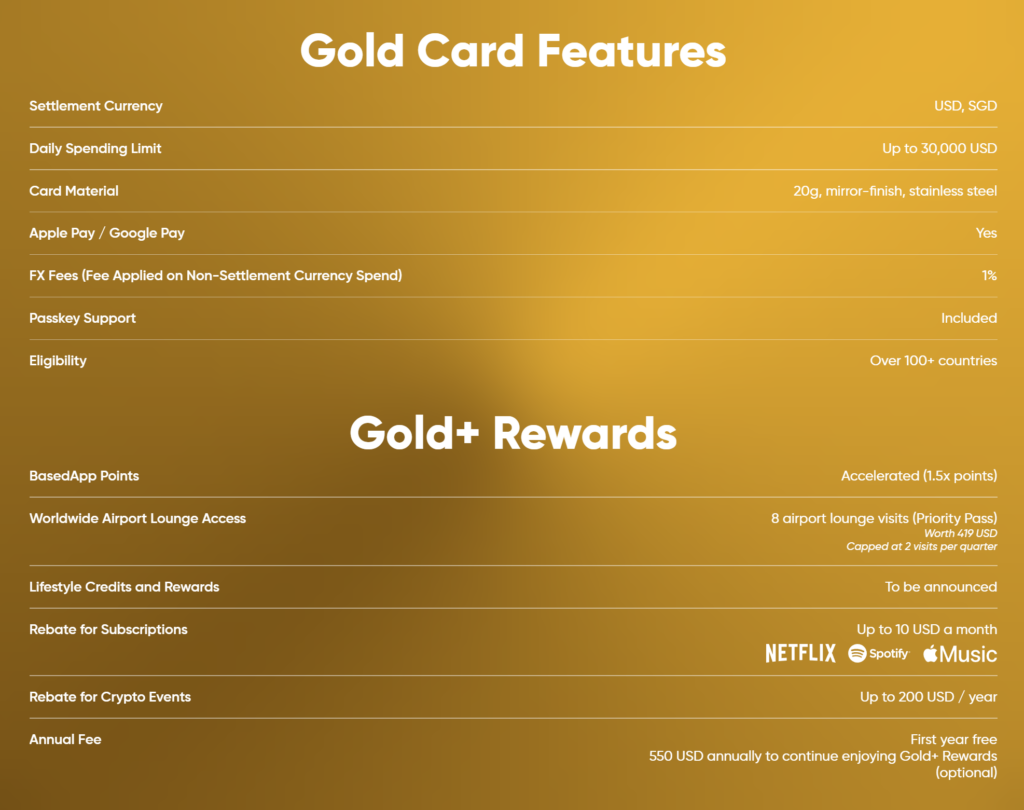

Gold Card and Gold+ Rewards

BasedApp has also recently introduced Gold+ Rewards program to distinguish the Gold Card from its more premium rewards program. While Gold Card holders stand to benefit from the perks such as higher spending limits, passkey support and settlement currency in both USD and SGD, it doesn’t come integrated with the lifestyle rewards.

Gold+ Rewards is where card holders who pay the $550 annual fee can enjoy benefits such as accelerated earn rate of 1.5x points, 8x worldwide lounge access annually, lifestyle credits and more. Gold Card members enjoy a complementary first year of Gold+ Rewards.

Why we like BasedApp

BasedApp eliminates the need to off-ramp your crypto into your bank account before making everyday purchases, especially for those who are heavily invested in crypto.

You can spend in your local currency with very low FX fees, which makes the based debit card among the most competitive cards in the market.

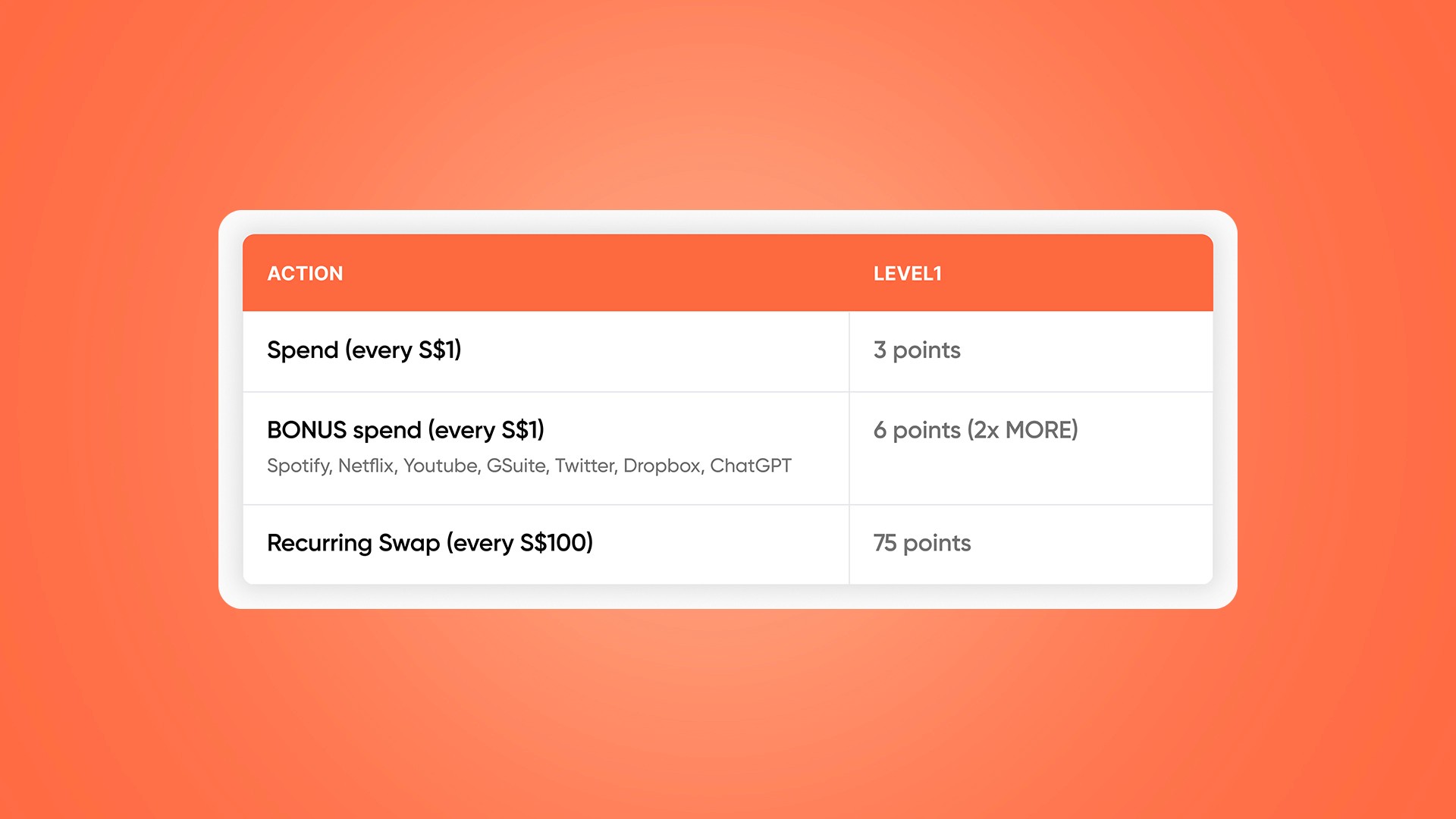

Based Rewards allows users to earn points on your spending but also on Recurring Swaps and future features like Invest within the app.

These points never expire, allowing users to accumulate over time and redeem for exciting rewards, at a rate of 5000 points = $5 reward. This translates to approximately 1% cashback for the base spending. 30,000 points may be exchanged for a $100 reward.

For certain merchants like Spotify, Netflix, YouTube and ChatGPT, spending will be awarded at a bonus rate of 6 points per $1 spent, or 2% cashback.

How to sign up for BasedApp

For those who want to sign up for a BasedApp card, use our referral link and receive 10,000 points ($33 equivalent) when you spend $500 within your first month.