In the ever-evolving world of Web3, connecting your crypto wallet to decentralized applications (dApps) can sometimes feel like navigating a maze.

WalletConnect is designed to streamline this process and enhance your interactions with the decentralized web.

What Is WalletConnect?

WalletConnect is an open-source protocol that bridges the gap between self-custody crypto wallets and decentralized applications.

It enables users to connect over 500 different crypto wallets to a wide array of dApps using a simple QR code scan.

This seamless connection not only facilitates interaction with dApps but does so with a focus on security and user control. Unlike traditional methods of connection, WalletConnect ensures that your private keys remain securely within your wallet, shielded from potential vulnerabilities.

How Does WalletConnect Work?

WalletConnect operates as a secure communication bridge between your crypto wallet and dApps.

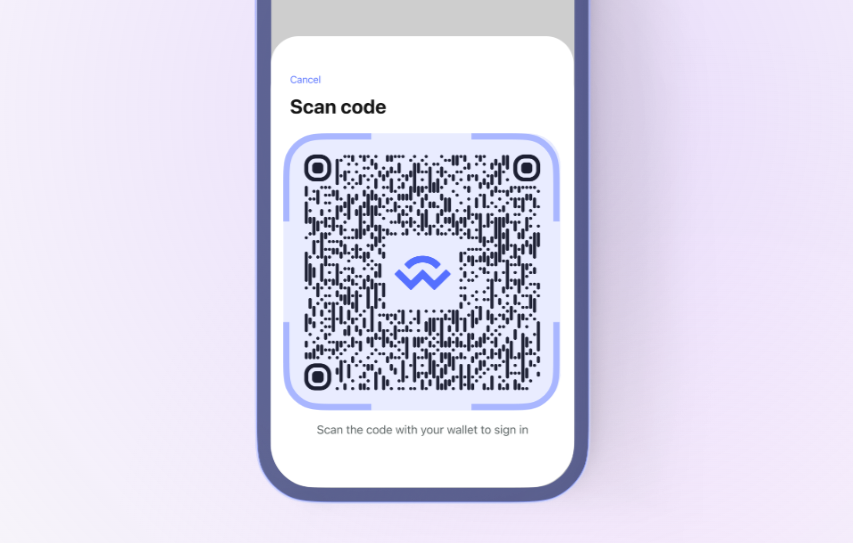

- Seamless Authentication: WalletConnect simplifies the authentication process by using QR codes to establish a connection between your wallet and the dApp.

- Secure Transaction Signing: It allows you to sign transactions securely without exposing your private keys to the dApp.

- Multi-Chain Support: Whether you’re interacting with Ethereum-based dApps or exploring other blockchain ecosystems, WalletConnect supports multiple chains, enhancing its versatility.

The protocol leverages encryption and QR technology to maintain a secure, encrypted link between your wallet and the dApp, ensuring that your interactions are both private and protected.

Connecting to a dApp Using WalletConnect

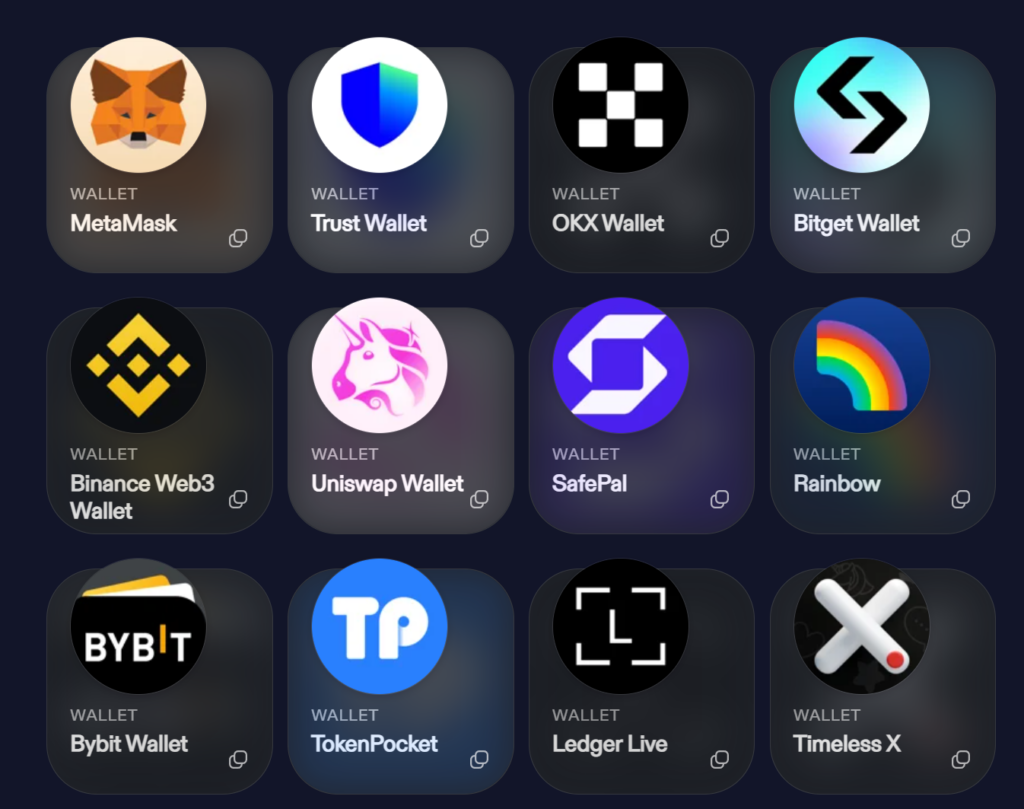

WalletConnect is supported by hundreds of wallets out there today as a popular means of connecting to decentralised applications.

Users may begin by installing a crypto wallet that supports WalletConnect. Popular choices include MetaMask, Trust Wallet, and Ledger Live.

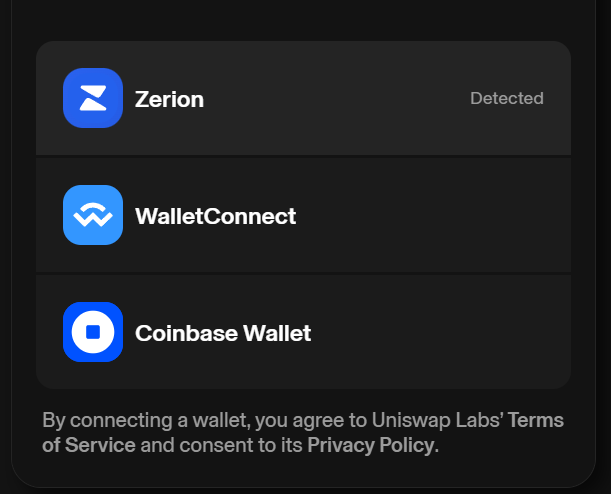

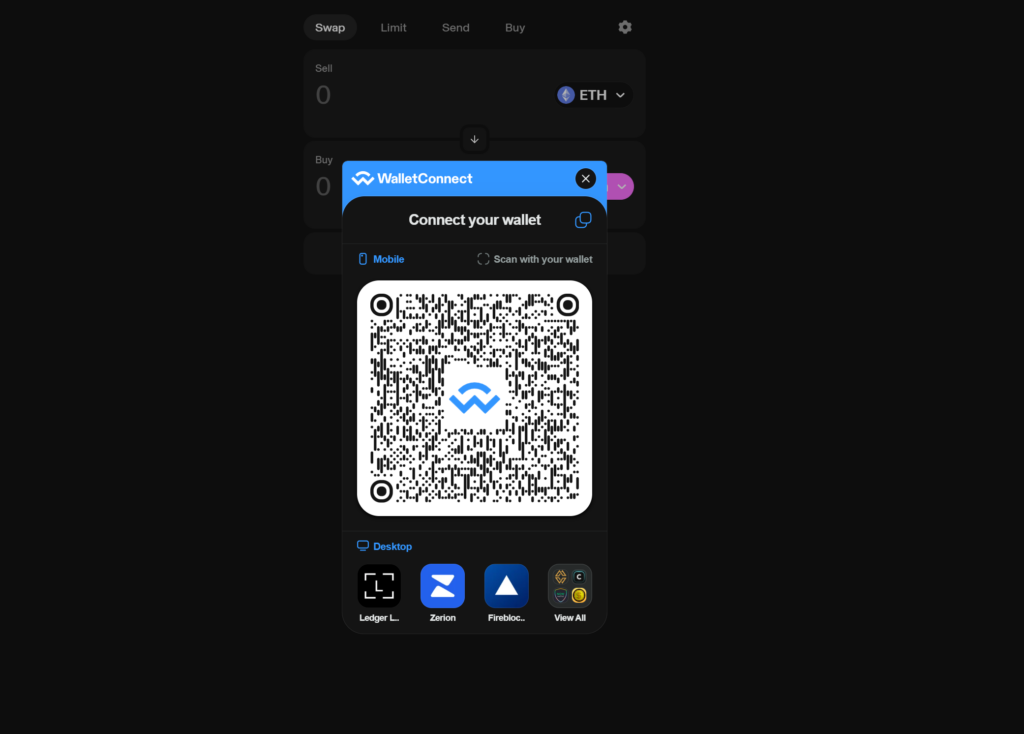

Then, navigate to the dApp you wish to interact with which supports WalletConnect. On the dApp, select ‘Connect Wallet’ and choose ‘WalletConnect’ from the options provided.

Open your mobile wallet app and use it to scan the QR code displayed by the dApp, and confirm the connection request on your wallet app.

Once connected, you can interact with the dApp seamlessly. Remember to disconnect your wallet after completing your activities to maintain security.

Is WalletConnect Secure?

Security is a paramount concern in the crypto space, and WalletConnect addresses this with several robust features:

- Encrypted Connections: WalletConnect ensures that all communications between your wallet and dApps are encrypted, safeguarding your data from potential threats.

- Private Key Protection: Your private keys never leave your wallet, minimizing the risk of exposure.

- Additional Security Measures: The protocol includes push notifications and decentralized messaging to alert you of any suspicious activity.

WalletConnect does not store user data on its servers, further enhancing privacy and security.

Why Use WalletConnect?

WalletConnect is not just about convenience; it’s also about providing a secure and user-friendly bridge to the decentralized web.

Whether you’re exploring decentralized finance (DeFi) platforms or engaging with NFT marketplaces like OpenSea, WalletConnect offers a versatile and secure solution for connecting your crypto wallet.