Derive, formerly known as Lyra, is a decentralized derivatives exchange with spot, perpetuals and options markets.

It is built on Derive Chain, a L2 optimistic rollup that settles on Ethereum.

Derive actually consists of 3 separate components, namely the Derive Chain, which is a settlement layer for transactions, the Derive Protocol, which enables permissionless, self-custodial margin trading, and the Derive Exchange, which is an order book-based exchange.

So what can you do on Derive?

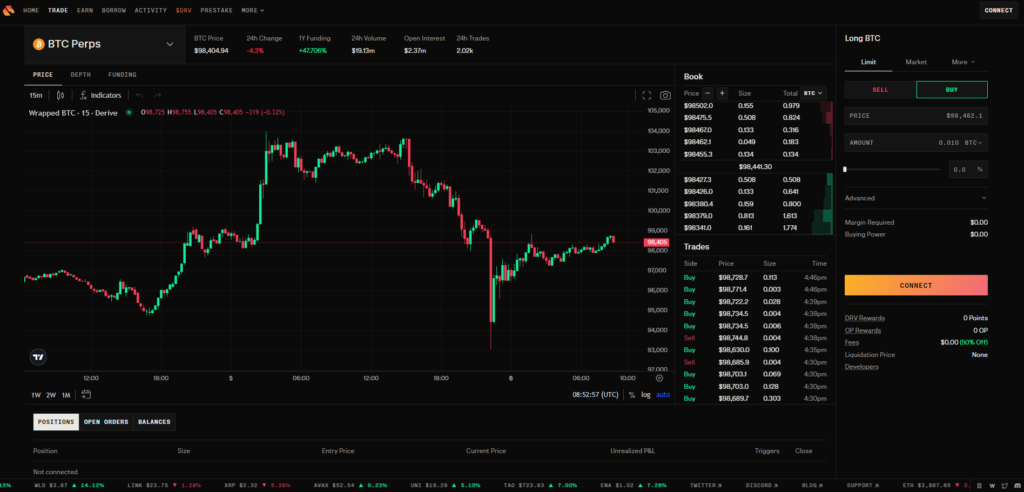

Trade Perpetuals on Derive

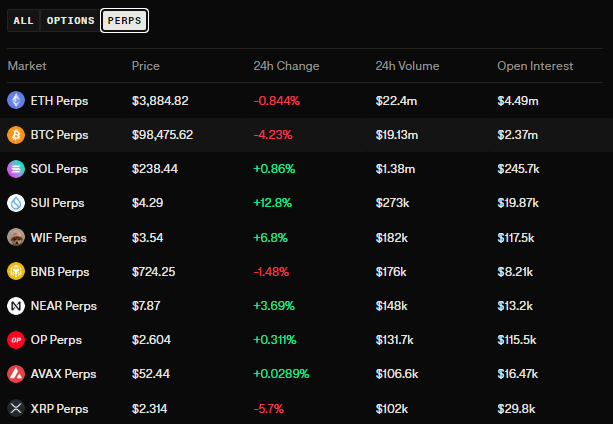

Derive supports perpetual futures trading for multiple asset types like BTC, ETH, and more with USDC as the quote asset.

The variety of markets available for perps means you are able to trade and speculate with a leverage of up to 20x.

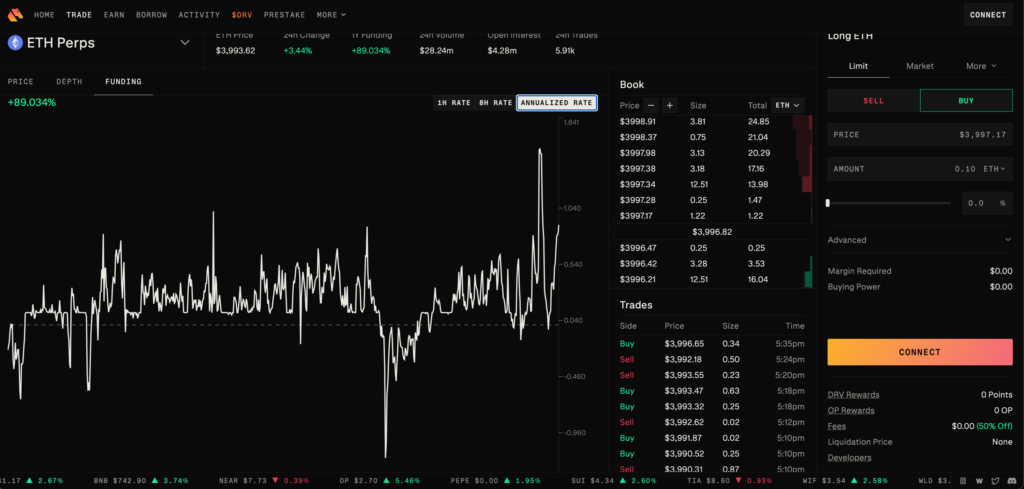

Delta neutral hedging on Derive

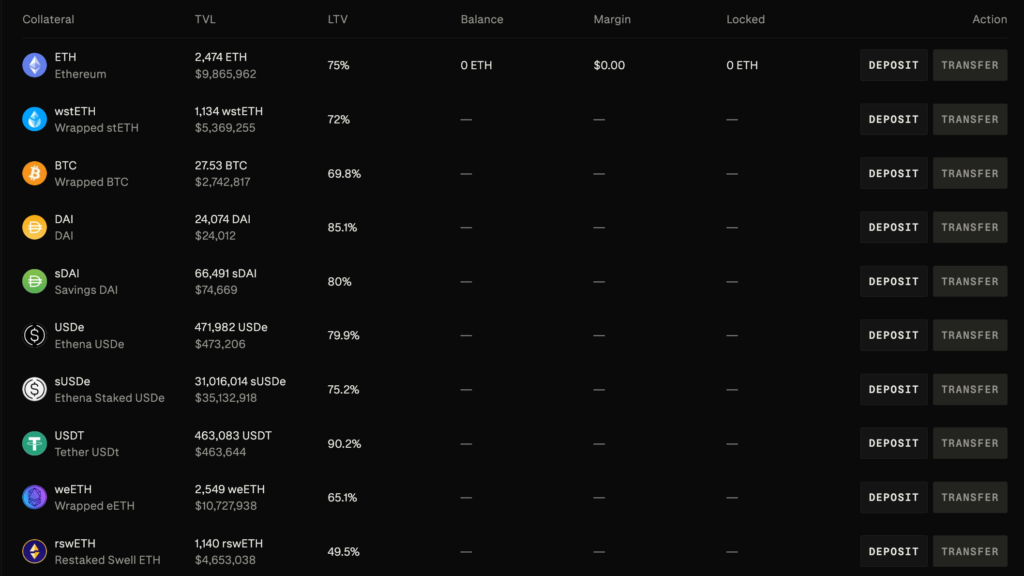

Delta neutral hedging is also possible on Derive – you can also hold the underlying base asset token as a collateral or hedge, i.e. long the asset on spot, and simultaneously short the perpetual futures contract on Derive, and collect funding premium.

The protocol can support any ERC20 token as collateral, being approved via on-chain governance. Currently, wETH, wstETH or wBTC tokens could be used as collateral.

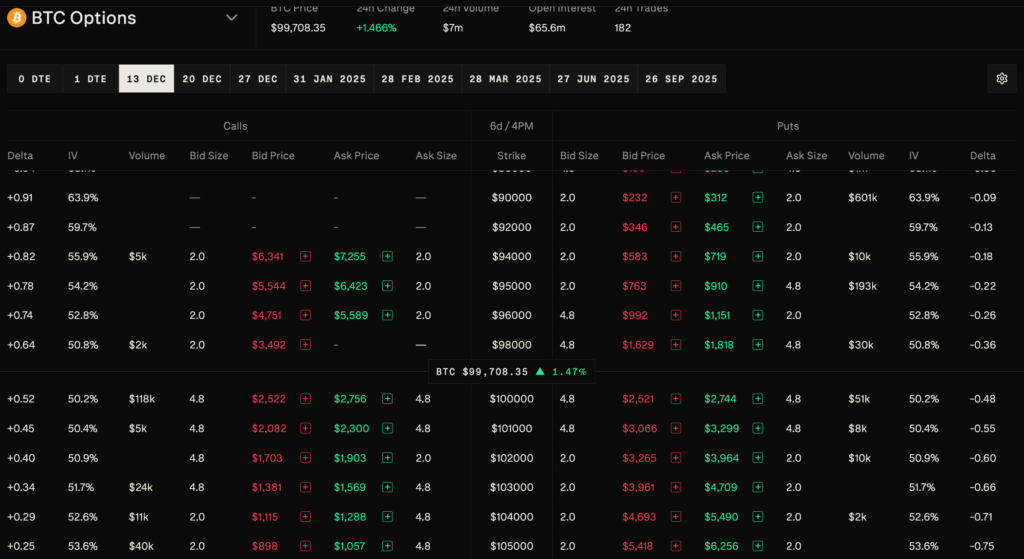

Options exchange

Derive is also an options exchange, supporting options on BTC and ETH across different dates, including 0 DTE and 1 DTE and as well as options expiring in 1 week, 2 weeks, 4 weeks and further ahead.

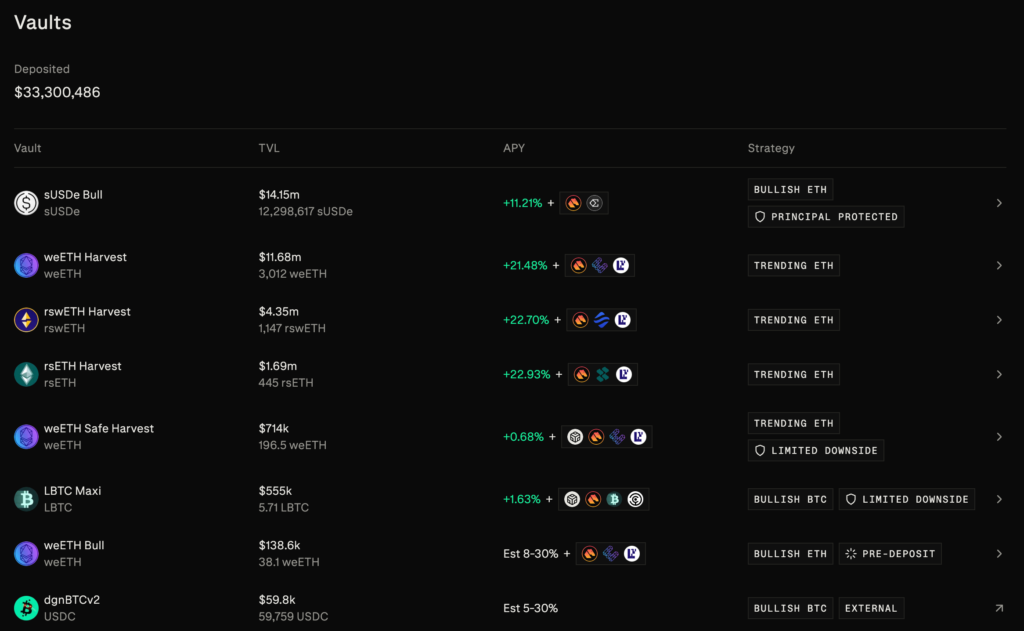

Earn Vaults

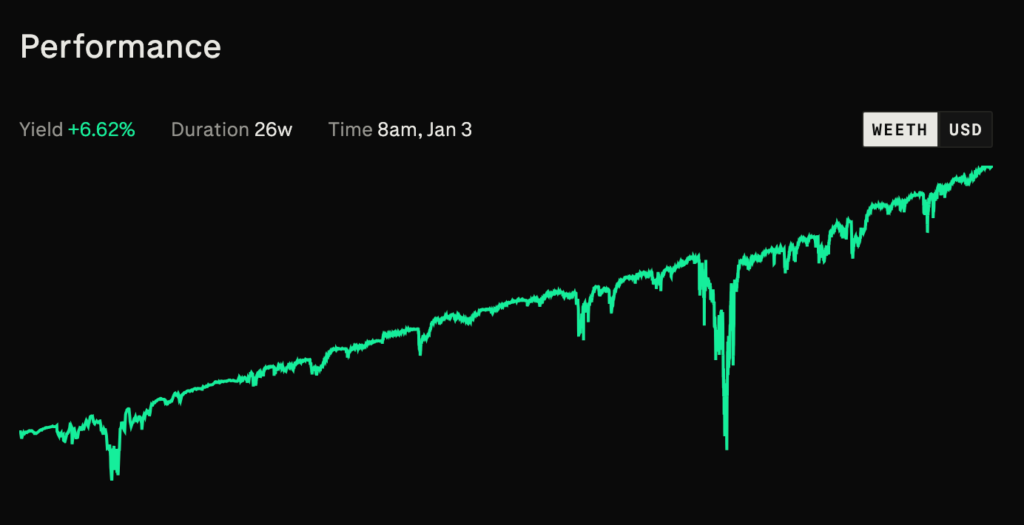

Derive’s Earn Vaults lets you deposit single asset liquidity into various forms of yield farming vaults that utilize some form of derivative strategy to earn yields.

For example, the weETH Harvest Vault has an automated strategy selling weekly out-of-the-money call options on weETH to generate USDC yield of around 20% APY.

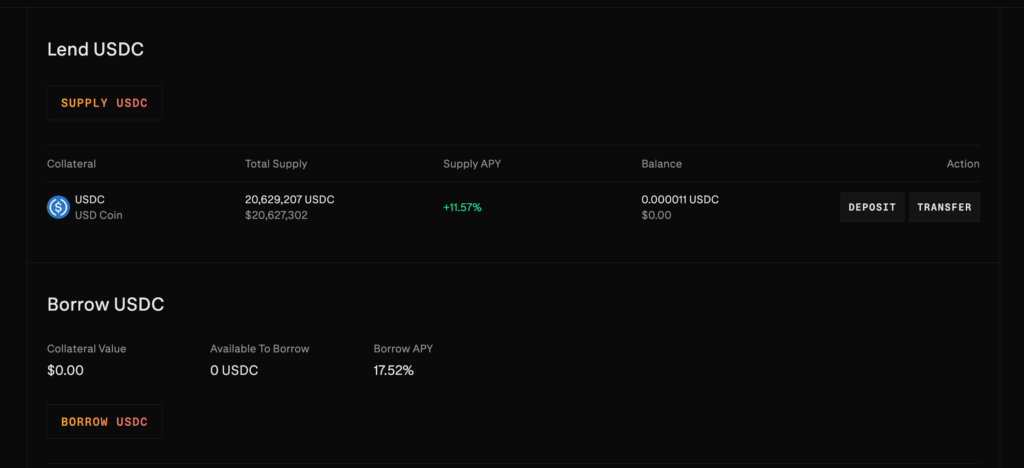

Borrow USDC

Derive also supports a USC lending market, where you can borrow USDC against your trading collateral.

Lenders and traders can also lend their USDC to receive periodic interest payments, although borrowing here allows traders to take leverage positions on Derive and on other platforms.

The good thing is Derive supports a wide variety of assets that can be used as trading collateral, including weETH and rswETH which are restaked ETH (which means you can farm points while borrowing).

DRV token

The DRV token is the utility token of Derive, which is a planned migration from the original LYRA token.

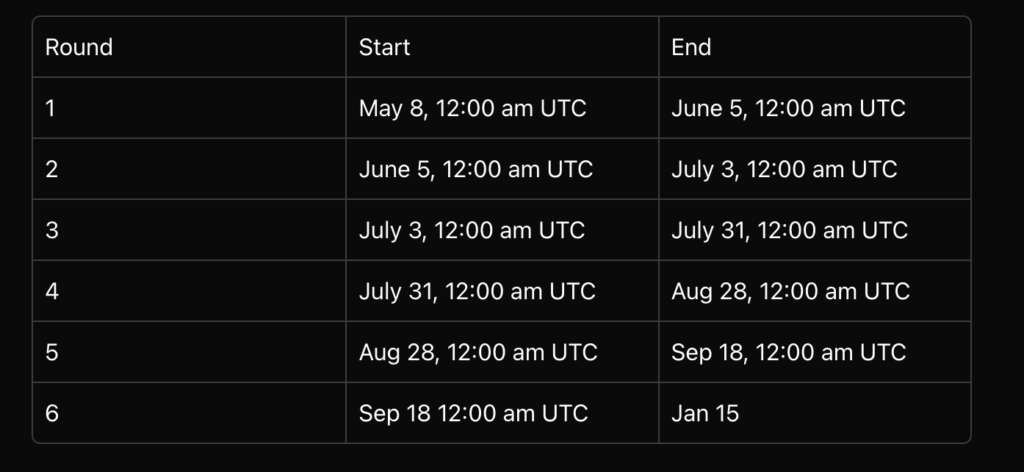

DRV’s token generation event is planned for 15 Jan 2025, and the airdrop for DRV will be based on program participation during multiple rounds starting from June 2024.

Traders can earn points in multiple ways – by trading, you can earn points for every US$1 in fee paid. You can also earn points by depositing into your trading account and their Earn vaults. Finally, you can also earn points by referring other traders to the protocol.

The points will allow you to level up in the program, the more points you earn during a round, the higher the level you unlock, and the greater the rewards you’ll receive.