Synthetix is a derivatives liquidity protocol, providing liquidity throughout DeFi and powering financial products and derivatives like perpetual futures, options, parimutuel markets, and more.

It powers a growing number of decentralised applications such as Kwenta, Toros, dHedge, Thales and more, which cover financial use cases like leverage trading, asset management and betting.

Synthetix liquidity

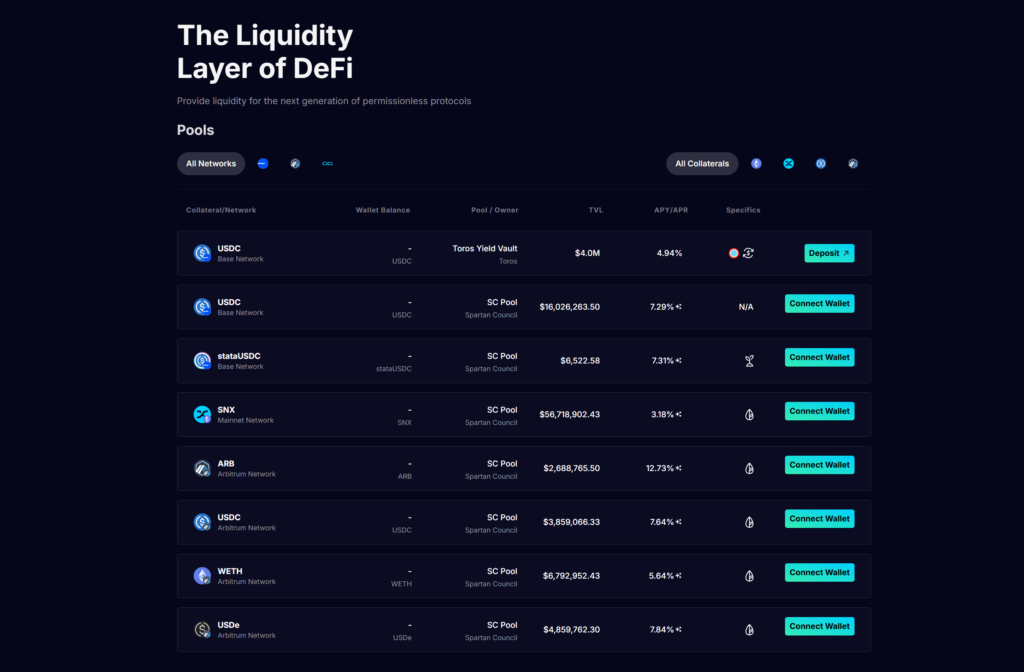

To power financial markets on the blockchain, Synthetix needs to attract liquidity – assets that power and backstop the financial markets where traders can take positions and place bets.

In Synthetix V3, liquidity providers can provide collateral to liquidity pools in the protocol, which allows them to obtain loans in the form of stablecoins, similar to protocols like Liquity and MakerDAO.

Currently, Synthetix V3 supports collateral like USDC, ARB, WETH, USDe and SNX across Ethereum mainnet, Arbitrum and Base.

This can be done directly through the V3 LP App or through an aggregator or third-party protocol like Toros, that can automatically compound and reinvest rewards.

Liquidity providers earn their share of trading fees and incentives for providing liquidity. Currently, Synthetix distributes its fees based on the following ratio: 40% to LPs, 40% to SNX buyback and burn and the remaining 20% to integrators.

Synthetix Token (SNX)

The SNX token is used for both governance and staking, of which staking is used to collateralise the network especially in Synthetix V2.

The SNX collateral is used against traders to trade against, acting as a pooled counterparty to all Synthetix Network exchanges. This collateral is not in use in the newer Synthetix V3, but SNX stakers can still benefit from the fees generated by Synthetix V3.

Stakers also need to maintain a certain collateralisation ratio known as the C-Ratio to be eligible for fee claims.

If they fall below the healthy ratio, currently 500% and can be changed by governance, they will be force liquidated with a penalty, and the staked SNX and sUSD debt is distributed to healthy stakers.

SNAXchain

Synthetix is currently live on Optimism, Arbitrum and Base. However, they have recently announced a new app chain called SNAXchain which is aimed at bringing cross-chain liquidity and trading-fee revenues to native-token stakers and onchain trading products.

The app chain will initially serve as an onchain governance platform to manage Synthetix deployments on Ethereum mainnet and layer-2 (L2) scaling chains, but they have bigger plans for this chain including launching staking for SNX, cross-chain liquidity, and powering a custom-built perps product.

Synthetix Ecosystem

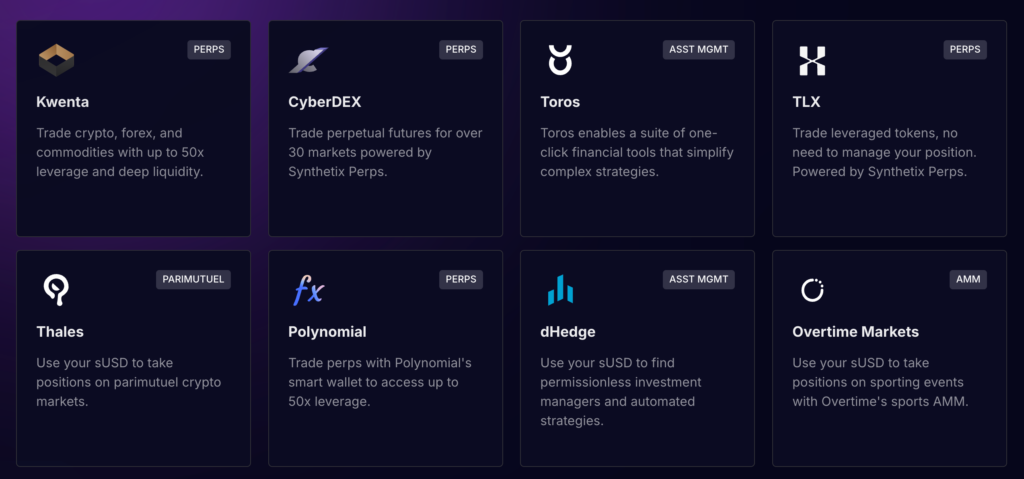

Synthetix builds no front end itself, it offers the liquidity backend that others can build upon.

The above is not an exhausting list of apps that are building on Synthetix, but they are typically markets or services that require a liquidity backbone which Synthetix can provide.

Here are some in greater detail:

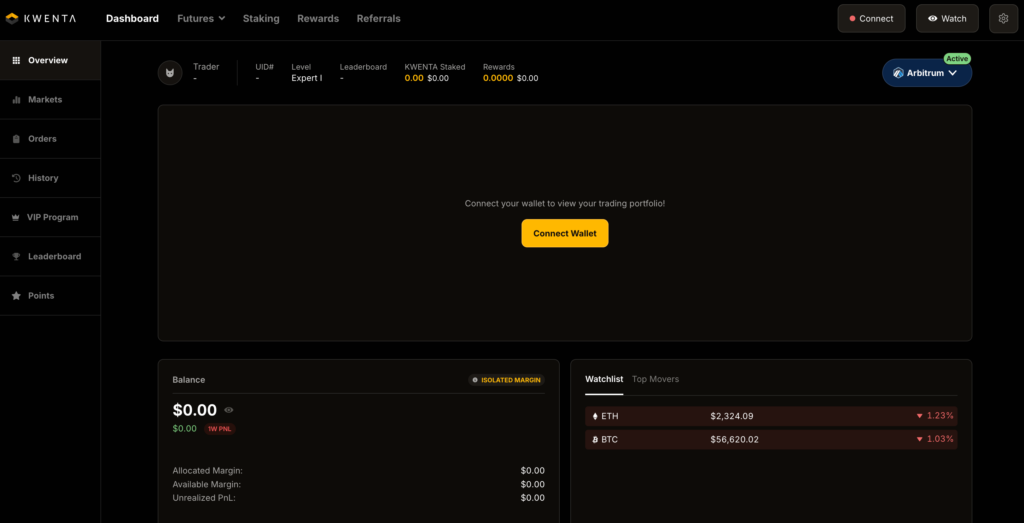

Kwenta

Decentralised perpetuals exchange Kwenta offers perpetual futures of up to 25x leverage trading on Optimism, Arbitrum and Base, allowing traders to gain exposure to a variety of on-chain and real-world assets.

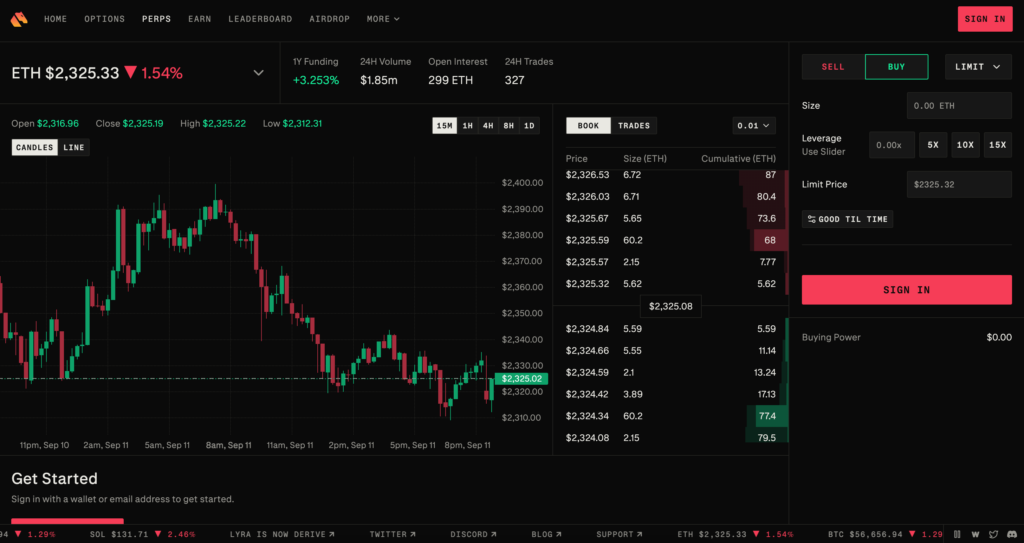

Derive (formerly Lyra)

Derive is a decentralised exchange that allows traders to trade options, perpetuals, and structured products.

Toros

Toros is a yield protocol that offers automated investment strategies in the form of “Vaults” to help users maximize returns on their cryptocurrency holdings and built on dHEDGE Smart Contracts. They offer a variety of yield products like delta neutral yield and stablecoin yield.

Conclusion

Synthetix is an OG DeFi protocol and has transformed itself over the years to better find product-market fit.

Its latest V3 edition of the app offers a better liquidity experience for a wider variety of assets that can be used as collateral to power the Synthetix network – and this change might be key to further unlocking its growth to be the liquidity powerhouse of DeFi.