Morpho is an innovative DeFi protocol designed to enhance the efficiency and attractiveness of lending markets.

How is Morpho different?

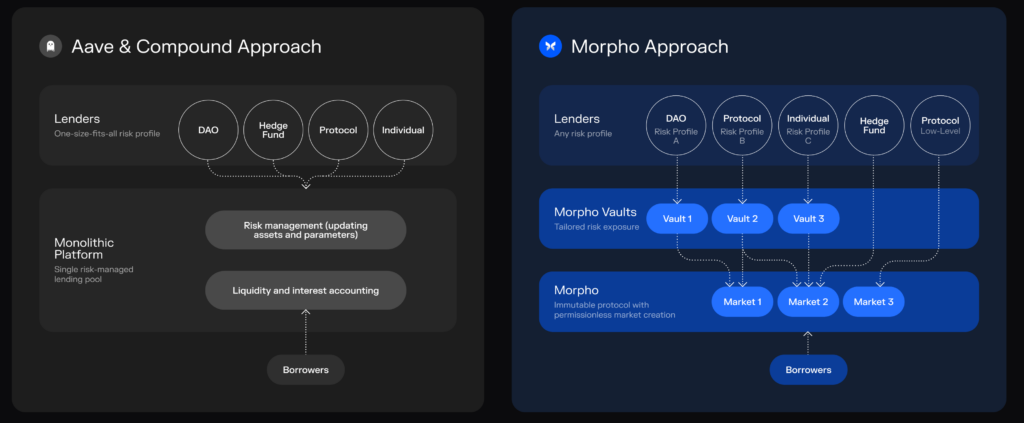

Aave and Compound are decentralized lending platforms where users can lend and borrow assets. These platforms typically use liquidity pools where lenders provide funds and borrowers take loans.

The challenges with this model include overcollateralization, where taking loans require more collateral than the borrowed amount, which can limit capital efficiency.

The second challenge is the yield spread – where the difference between the interest rates paid by borrowers and earned by lenders could be very high.

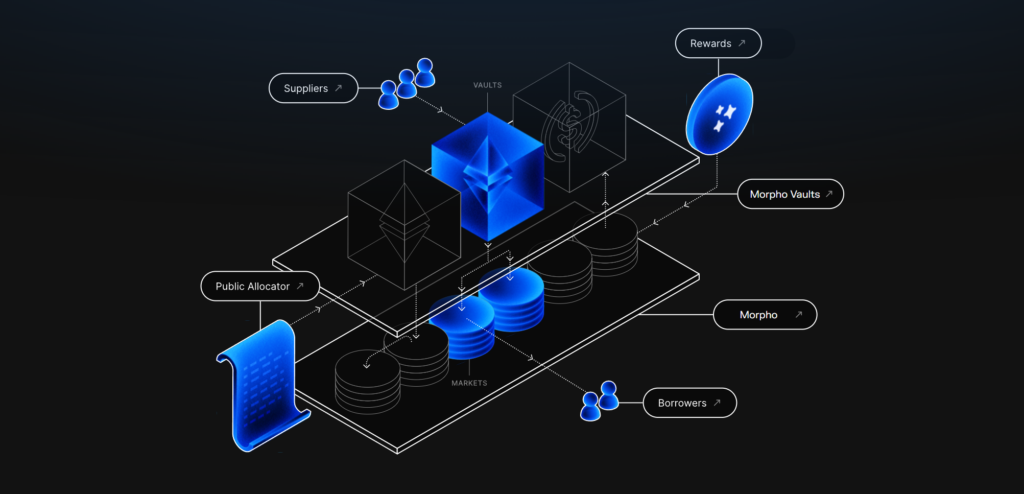

Morpho enhances the traditional lending market through the deployment of minimal, permissionless and isolated lending markets by specifying one collateral asset, one loan asset, the loan-to-value, an interest rate model, and an oracle; making it more efficient and flexible than any other decentralized lending platform.

Morpho is implemented as an immutable smart contract, engineered to serve as a trustless base layer for lenders, borrowers, and applications and is currently deployed on Ethereum and Base networks.

Morpho

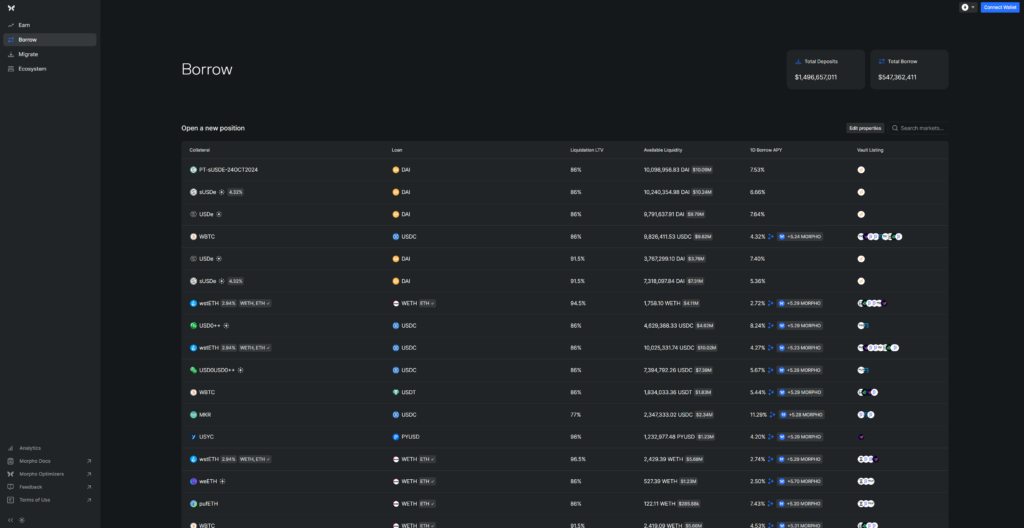

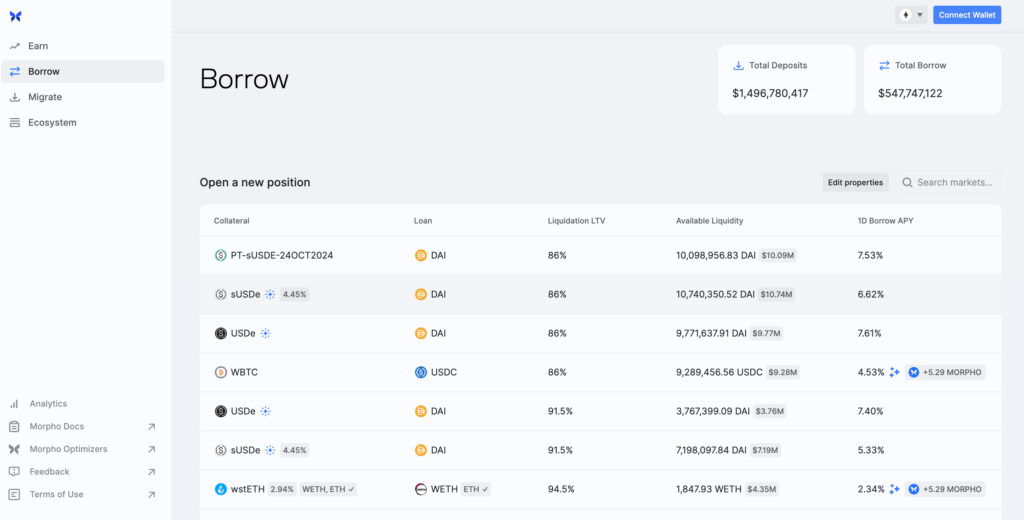

Morpho’s main concept is simple – deposit any supported asset and participate in overcollateralized lending and borrowing – i.e. lenders can earn interest on supplied assets and borrow an amount less than the value of the collateral assets supplied, paying interest over time.

Since Morpho’s lending markets are isolated to the asset pair, liquidation parameters for each market can be set without consideration of the most risky asset in the basket.

Therefore, suppliers can lend at a much higher LTV while being exposed to the same market risk as when supplying to a multi-asset pool with a lower LTV.

Collateral assets are also not lent out to borrowers, so liquidity requirements for liquidations to function properly are alleviated, allowing Morpho to offer higher capital utilization.

Morpho is also governance minimised, with low fees and improved spreads.

Morpho Vaults

Morpho Vaults are only one example of permissionless risk management on top of Morpho where any entity, DAO, or protocol can build services and tools that help manage risk on behalf of users.

Morpho Vaults facilitate the supply of liquidity to Morpho markets. On Morpho, suppliers must consider multiple factors, including collateral assets, liquidation LTV, oracles, and caps.

Users can delegate risk management to a vault which can automate and decentralize these decisions, similar to platforms like Aave or Compound, making for a more passive experience.

Use cases with Morpho

There are many use cases with Morpho, ranging from simple to more complex yield strategies.

Morpho’s simplest use case is just depositing a supported collateral token and collecting yield, and paying the loan interest rate to borrow the loan token.

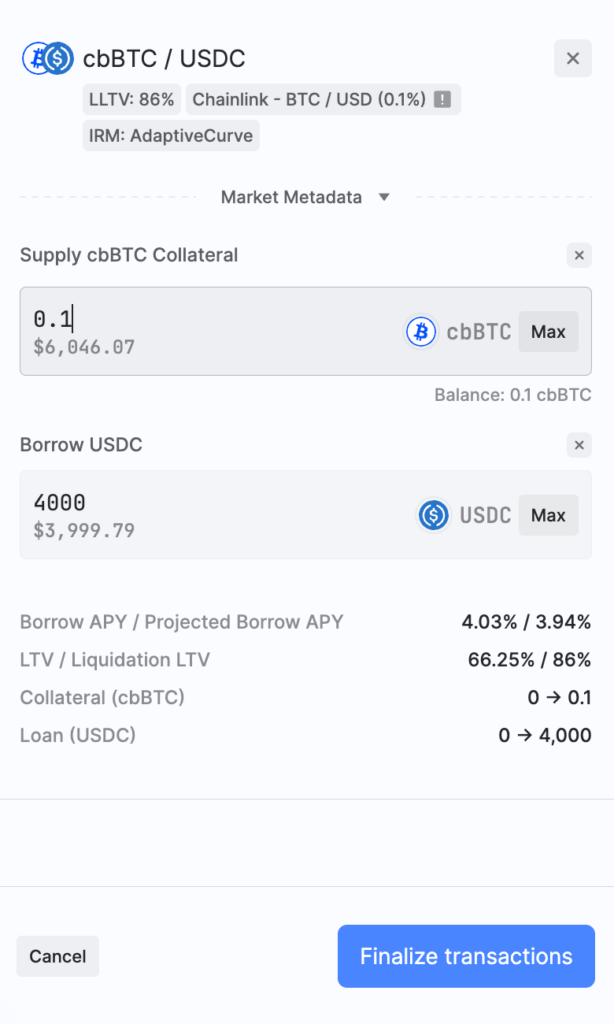

For example, you could borrow USDC on cbBTC collateral similar to Aave, but at a higher LTV of 86%.

There are also more exotic strategies available, such as using PT-sUSDE, or the staked Ethena USDe principal token from Pendle and borrowing DAI on it. You could lock in a fixed yield from Pendle and realising your collateral value using DAI.

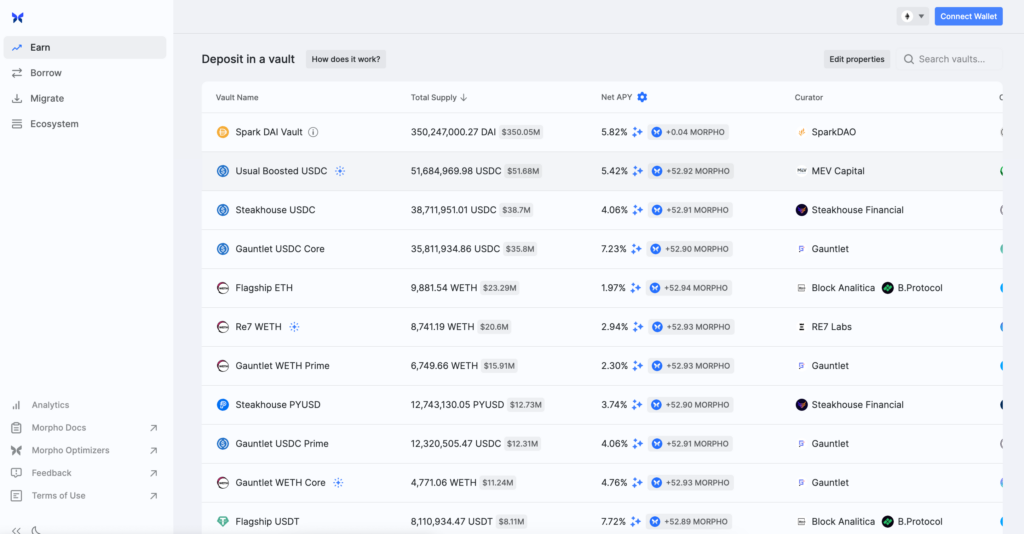

If you’re more flexible in terms of investing strategy and wouldn’t mind delegating the strategy to a third party, then Morpho Vaults will allow you to earn interest from lending and additional MORPHO tokens.

Conclusion

Morpho showcases its simplicity, flexibility, and capital efficiency in a refined manner where layers or DeFi legos can be potentially stacked together to achieve much higher capital efficiency compared to traditional strategies.